Ceredigion County Council budget 2026-27

This campaign closed 9th January 2026.

The responses were presented Councillors in the meeting of Cabinet on 10 February 2026.

Read the officer's report and engagement feedback report here: Report- Budget Engagement 2026-27 Feedback Report.pdf.

Your responses informed the report on the 2026-27 Revenue Budget and the Multi Year Capital Programme. This report can be read in full here: Ceredigion County Council (item 147).

Decision:

1. To note that Mid & West Wales Fire Authority’s approved 26/27 Fire levy for Ceredigion County Council is £5.935m, which following the additional WG grant, results in a £56k cost pressure on the Council’s 26/27 Budget (equivalent to a c0.1% Council Tax increase for Ceredigion residents).

2. To approve the schedule of Fees & Charges to be effective from 01/04/26 as outlined in:

- Appendix 1

- Appendix 2

- Appendix 3

- Appendix 4

3. To recommend to Full Council that:

- the 26/27 Budget Requirement is £221.499m.

- the level of the 26/27 Council Tax for County Council purposes is a 4.75% increase, which would equate to a Band D annual increase of £89.61 (being £7.47 per month).

- the updated Multi Year Capital Programme, as presented to Cabinet on 13/01/26, is approved.

- the Capital Strategy, as presented to Cabinet on 13/01/26, is approved.

Reason for the decision:

To enable the 2026/27 Budget preparation to continue, so that Budget papers and Council Tax calculations can be prepared for the Full Council meeting on 02/03/26.

Original Engagement

Local councils across the UK are under serious financial pressure. The cost-of-living crisis means everyday essentials like food and energy bills are rising faster than most people’s incomes, making life harder for everyone.

Public services face the same problem because the funding we receive isn’t increasing enough to cover these higher costs.

Inflation means it’s more expensive for Councils to provide services – not just big projects like building schools but also paying energy bills for schools and care homes and maintaining roads. On top of this, an ageing population and more complex social care needs for all ages are putting extra strain on budgets.

These cost pressures aren’t unique to Ceredigion. They include:

• Nationally agreed pay rises

• Government decisions like higher employer National Insurance contributions

• Inflation on supplier contracts

• Increased fire service costs from Mid & West Wales Fire Authority

• Welsh Government’s pledge to pay social care workers at least the Real Living Wage

By law, councils must set a balanced budget – we can’t spend more than we have. Most of our funding comes from the Welsh Government, council tax, and income from fees and charges.

Ceredigion County Council has a strong record of balancing its budget and usually gets positive reports from Audit Wales. Our latest external review (October 2024) said that despite high demand for services and tough financial pressures, we are a well-run Council. However, we now face very difficult choices about which services we provide, what we prioritise, and how we fund them.

2026/27 Budget

On 24 November 2025, the Welsh Government announced the provisional core funding for all councils in Wales for the 2026/27 financial year.

For Ceredigion, this means a funding increase of 2.3% (worth about £3.3 million) on a total council budget of £209 million. This is the lowest increase in Wales. For comparison, Newport City Council - receiving the highest increase in Wales - will get a 4.3% increase (worth about £14 million).

Based on early estimates, this leaves the Council with a £6 million budget gap before any changes to Council Tax. To close this gap without cutting services, Band D Council Tax would need to rise by about £11 per month (around 7%). If the increase is lower, there will have to be major cuts to frontline services. After more than a decade of tight budgets, this would likely mean stopping or closing some services completely, not just making small reductions.

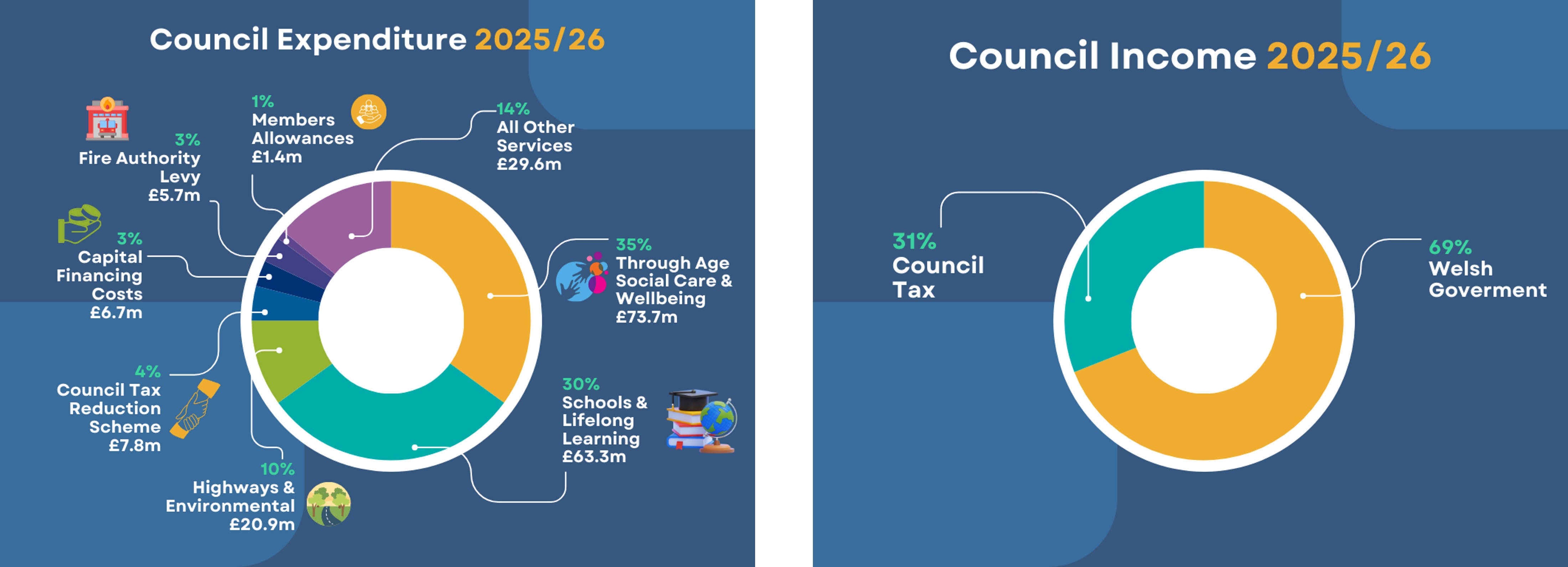

Over 10 years ago, the income chart would have looked very different. Welsh Government funding was closer to 80%. The percentage covered by Council tax would have been lower.

Part of the Council’s gross expenditure is funded by £45 million from external grants and about £36 million from fees, charges, and other income.

We want to hear from you

Before we set our budget for next year we'd like to hear from you.

Before you complete the survey below, you may want to try out our budget simulator to have a go at balancing the Council budget. This won’t collect your views; it’s just for fun – why not have a go?

We have also provided some additional information on the Council’s budget in the Frequently Asked Questions below. You may find it useful to read these before completing the survey.

The results of this engagement will be carefully analysed and taken into consideration as we prepare the budget for 2026-2027, thank you for taking part.

Complete our on-line survey - Ceredigion County Council Budget 2026-27 Engagement – Fill in form

Download a paper copy - 2026-27 Budget Engagement: Information and survey - Ceredigion County Council 2026 27 Budget Engagement.

You can also collect a paper copy from your local Library or Leisure Centre or by calling 01545 570881 or emailing us at clic@ceredigion.gov.uk.

If you wish to receive the information in a different format, please contact us on 01545 570881 or email clic@ceredigion.gov.uk.

Please return paper copies to your local library or to Finance and Procurement Service, Ceredigion County Council, Ceredigion County Hall Penmorfa, Aberaeron SA46 0PA.

Click here to read our Consultations Privacy Notice.

You may want to try out our budget simulator to have a go at balancing the Council budget. This won’t collect your views; it’s just for fun – why not have a go?

However, we do value your views. Please read the information and FAQ and then complete the survey to tell us how you think the Council’s budget should be spent.

Frequently Asked Questions

Ceredigion County Council gets most of its funding from Welsh Government through the Revenue Support Grant, which includes a share of national business rates. We add to this by collecting Council Tax. You can read more about Council Tax in our booklet: Information for Council Tax Payers 2025-2026.

Income

• Welsh Government Revenue Support Grant and National Non-Domestic Rates (NNDR): £144,225,000

• Council Tax: £64,939,000

• Total funding: £209,164,000

Some of our gross expenditure is funded by external grants for specific projects or schemes. These grants usually have strict conditions attached. We also raise income for gross expenditure through fees and charges – some set by the Council and others by other organisations e.g. national bodies.

• Specific grants: £45,061,000

• Fees charges and other income: £36,191,000

The Council provides a wide range of services to local people, most of which we are legally required to deliver.

You can see a snapshot of these services here: Budget Infographic

Around 75% of the Council’s Budget (£158m) is spent on the 3 main frontline (and mostly statutory) service areas:

• Through Age Social Care & Wellbeing: £74 million

• Schools & Lifelong Learning: £63 million

• Highways & Environmental Services: £21 million

Around 10% (£22 million) goes on largely fixed costs:

• Councillor salaries and allowances (set independently): £1 million

• Fire Authority levy: £6 million

• Capital financing costs: £7 million

• Council Tax Reduction Scheme: £8 million

That leaves just under £30 million (14%) for all other Council Services

The money that councils spend on the day to day running of services is called the Revenue Budget. This includes expenditure on staff salaries and wages, payment to suppliers and running costs of buildings e.g. energy costs, maintenance. It also includes income from various sources including fees & charges, leases and specific grants.

The council must set its budget by 11 March each year for the following financial year, 1 April to 31 March.

The Council prepares a Council Tax booklet each year which can be found at: Ceredigion County Council Information for Council Tax Payers 2025-2026

The Council also prepares a detailed budget book that covers all planned expenditure and income for the year which can be found at: Budget Book Information - Ceredigion County Council

By law, councils must set a balanced budget. This means creating a financial plan based on realistic assumptions that shows income will match spending in the short and medium term.

The plan considers funding from Welsh Government, Council Tax, and unavoidable cost pressures. To balance the budget, councils can:

• Reduce spending (make savings)

• Increase income by raising fees and charges for some services

• Review Council Tax levels

When we say ‘savings,’ we mean reducing a service’s budget.

For example, if a service costs £100,000 to run but we only have £80,000, we need to make a saving (or budget reduction) of £20,000. This means we must either cut spending on that service, increase income, or do a mix of both.

Reserves are funds set aside for specific future needs or emergencies. There are two types of Council reserves:

• Earmarked reserves – already allocated for specific projects or schemes (e.g., matched funding).

• General reserves – kept for unexpected emergencies and to maintain working capital for cashflow.

Reserves can only be used once. They cannot fund ongoing costs like staff salaries because once spent, they’re gone. Using them for day-to-day spending would leave the Council vulnerable if an emergency or major unexpected cost arises.

Gross Expenditure is the total amount the Council spends before subtracting any income (like fees and charges, property rental income, or specific grants).

Net Budget is what’s left after subtracting that income. This is the amount funded by Welsh Government core funding (Revenue Support Grant, including a share of business rates) and Council Tax.

Each service has a ‘controllable budget,’ which covers all spending and income that the service directly manages.

Once this budget is approved, the service can spend and receive income as long as it stays within its total controllable budget.

Some costs, like Finance, ICT, HR, and Legal, are shared across services and charged back as non-controllable costs. These recharges balance out across the Council, so they don’t affect the overall budget.

Support services also have their own controllable budgets for their operating costs and income.

When the Council reports on its budget (including in this budget engagement), the focus is on controllable budgets, with recharges shown only where required for statutory reporting.

Non-Domestic-Rates, also known as business rates, are taxes on businesses which help to contribute towards the costs of local authority services. Business rates are based on the rateable value of your business; this is set by the Valuation Office Agency and not by the Council.

Your business rates are calculated by taking the Rateable Value of your property and multiplying it by the current non-domestic rates 'multiplier'. The multiplier is set by Welsh Government each year, not the Council.

The multiplier for 2025-26 financial year is 0.568.

Local authorities collect non-domestic rates from business owners. These amounts are then pooled centrally by Welsh Government before being redistributed by Welsh Government to local authorities based upon population.

Welsh Government has several schemes in place that allows certain businesses to claim a reduction on the amount they pay. These include Small Business Rates Relief or Retail, Leisure and Hospitality Rates Relief. The council can advise you if you are eligible for such discounts.

Further information can be found at: Non Domestic Rates - Ceredigion County Council

The capital programme covers all the Council’s capital budgets, which fund projects to buy or improve assets.

Examples include building new schools, major refurbishments, or resurfacing roads.

This is a long-term budget and is funded differently from the revenue budget. The capital budget is mainly funded by:

• Capital grants from Welsh Government

• Borrowing (within strict government limits)

• Capital receipts – money from selling assets, which can only be used to repay debt or support the capital budget.

Legally we are not allowed to use capital receipts, specific capital grants or borrowing to pay for day-to-day services.

For example, if we were to sell one of our council offices, the money received would be a capital receipt and could only be used to repay debt or for the capital budget. It could not be used for general running costs of social care or libraries or other services.

The band D equivalent is a standard measure of council tax and is used by all local authorities and Welsh Government.

Every domestic property in Ceredigion has been valued by the Valuation Office Agency. Once valued, properties are allocated one of nine valuation bands (Bands A to I).

Each band is multiplied by a given factor to bring it to the Band D equivalent. For example, one band H property is equivalent to two band D properties, because a taxpayer in a band H property pays twice as much council tax, as outlined below.

The table below shows the number and percentage of dwellings by property band in Ceredigion:

| Band | Number of dwellings in Ceredigion | Proportion |

| A | 1,612 | 5% |

| B | 4,635 | 14% |

| C | 7,303 | 21% |

| D | 7,180 | 21% |

| E | 8,586 | 25% |

| F | 3,601 | 11% |

| G | 933 | 3% |

| H | 100 | 0% |

| I | 20 | 0% |

The table below shows how much other Bands pay relative to a Band D property.

These multiples / ratios are set in legislation.

| Band | Fraction (relative to Band D) |

| A | 6/9ths (or 2/3rds) |

| B | 7/9ths |

| C | 8/9ths |

| D | 9/9ths (or 1) |

| E | 11/9ths |

| F | 13/9ths |

| G | 15/9ths |

| H | 18/9ths (or 2) |

| I | 21/9ths |

The Council Tax you pay isn’t based on which services you personally use. It helps fund the Council’s overall budget so we can provide hundreds of services for everyone in Ceredigion.

People use different services at different stages of life:

Early years: Registering a birth, school transport, nursery, primary and secondary education, and post-16 education.

Adulthood: Using sports centres or libraries, walking public paths, registering to vote, submitting planning applications, eating in safe and regulated food establishments, having waste collected, driving on maintained roads and bridges, using public buses, having streetlights, and calling Fire & Rescue in emergencies.

Later years: Benefiting from concessionary bus fares and possibly needing care and support services. This could include equipment for independent living, home care, residential care, and eventually services like the Coroner and registering a death.

To make sure the Council has a fair and transparent pay structure, all jobs covered by National Joint Council conditions for Local Government are evaluated using the Greater London Provincial Council job evaluation scheme.

This scheme uses 11 factors, a scoring system, and weightings designed to be free from gender bias and discrimination. Ceredigion County Council does not pay any bonuses (performance or specific).

Teachers’ annual pay awards are set by Welsh Government for all of Wales and usually start in September each year. For most other staff, pay awards are decided nationally by the National Joint Council (NJC) for Local Government Services across England and Wales, usually starting in April.

There is a similar national process for Chief Officers and the Chief Executive.

The Council does not control or decide annual pay awards for any of its staff.

Being a Councillor requires a significant time commitment, and even more so for Cabinet Members or Committee Chairs.

Councillors receive an allowance (a salary) to reflect this commitment. The aim is to provide a fair and reasonable allowance to support and encourage a diverse range of people to stand for election.

If no allowance was paid, fewer people might put themselves forward, and those from poorer or disadvantaged backgrounds could be excluded, which would be unfair.

The annual allowance (salary) for Councillors is set by the Democracy and Boundary Commission Cymru, not Ceredigion Council.

There are 51 town and community councils across Ceredigion. They provide or maintain a range of local community services.

The services they deliver is different based on the needs of each individual town or community. Some of the services provided by town and community councils include:

• maintaining buildings and/or community centres,

• refurbishment of local bus shelters and benches,

• provision and maintenance of flower beds,

• refurbishment of play areas, provision of community notice boards,

• maintaining footpaths,

• Remembrance Day events,

• Christmas decorations, and many more.

Each town and community council sets a ‘precept’ each year to deliver local services, the amount of precept charged by your local town or community council is shown on your overall council tax bill. Ceredigion County Council collects the precept and then pays the town and community councils their share.

The Police and Crime Commissioner is responsible for making sure the police service is effective and efficient by holding the Chief Constable to account.

The Commissioner helps Dyfed Powys Police understand and respond to community needs and plays a key role in community safety and crime reduction. His duties include:

• Setting local policing priorities

• Scrutinising, supporting, and challenging police performance

• Setting the annual police budget

The Commissioner also sets a ‘council tax precept’ each year, which appears on your council tax bill. Ceredigion County Council collects this precept and passes it to the Police and Crime Commissioner’s Office.

Click here to read more about Dyfed Powys Police and Crime Commissioner.

The UK Government has recently (13/11/25) announced that Police and Crime commissioners are to be scrapped in England and Wales at the end of their current term in 2028. Further information is awaited on what this means in Wales.

Funding for the Mid & West Wales Fire Service is shared between six local authorities in the region, based on population.

The Fire Authority sets the annual Fire Levy and tells each council what their share is. The Council must then include this amount in its budget, which adds pressure to our finances.

In recent years, the Fire Levy has increased much faster than the funding we receive from Welsh Government.

For example, Ceredigion’s contribution rose from £5.4m in 2024/25 to £5.8m in 2025/26 – a 7.3% increase, which is equal to about 0.6% on Council Tax.

Unlike policing costs (shown separately as a precept on your Council Tax bill), the Fire Levy is included within the Council’s overall £209 million budget.

More information on the Fire Service can be found at www.mawwfire.gov.uk.

If you’re on a low income or receive certain benefits, you may be able to get help with paying your Council Tax.

Around 5,000 households in Ceredigion currently benefit from the Council Tax Reduction Scheme. This scheme helps people on very low incomes and/or claiming benefits, and in some cases can reduce Council Tax by up to 100%.

It’s a means-tested benefit, so the amount you get depends on your income, savings, and personal circumstances. Even if you’re working, you might still qualify. However, if you have £16,000 or more in savings (not counting the value of your home), you won’t be eligible.

You can use the Entitlement Calculator on the Council’s website to check if you might qualify for support.

You can also opt to pay your council tax over 12 months instead of 10, or as many months that remain in the current financial year.

The easiest and most efficient way to pay your council tax, or change the way you pay, is to sign up to My Account and to pay by Direct Debit.

You can also register to receive your Council Tax bill electronically to help save the Council money on the cost of printing and postage.

My Account is a personalised service for Ceredigion County Council residents. Registering is quick and easy and all you need to get started is an email address.

Using My Account to submit your forms means we receive them immediately, which saves you time and money.

You can read more about My Account on our website - Welcome to My Account - Ceredigion County Council.